Apple is partnering with Goldman Sachs & MasterCard to revolutionise the way credit cards are used. This card is expected to be launched this summer 2019 in the USA, that is sometime between July to September 2019 and would be available to rest of the world in around 40+ countries by the end of this year. India hopes to be one of them.

The card that will work worldwide and be built directly into the Apple Pay wallet app on Apple devices such as an iPhone or Apple Watch. This card is available in virtual as well as physical form, the physical form is ‘titanium and laser etched’ plain card like other credit cards. The physical card can be used where they do not accept Apple Pay. This physical card has no number, no CVV, no expiry date and no signature panel. It has just your name inscribed on it. But, this information is available in the Apple Wallet on iPhone. So when making a payment at a merchant location, NFC is used to make payment using an iPhone. Physical Apple Card alone can’t be used to make payment like other credit cards; iPhone is required to complete the transaction.

Apple Credit Card Unique Cool Features

-

-

- The customer can tap on the charge to see the location of the merchant on the map where this transaction was done. A very friendly feature as many times the merchant establishment does not appear on the card statement; instead, the merchant’s parent organization gets listed which becomes quizzical.

-

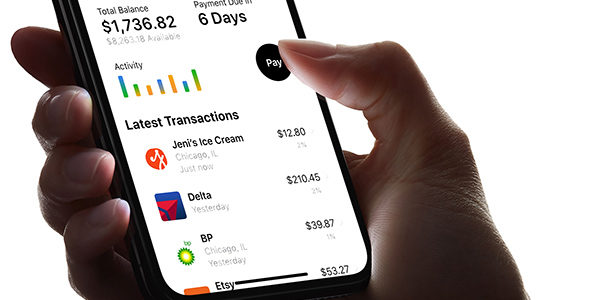

Colorful spending summaries -Inbuilt spend analysis/ financial management tool – All spends get categorized and color-coded, say entertainment is pink color, foods & drink is orange and so on and so forth. The same color is used to depict the spend in graphical format. Customer can view the spend by week or month.

- This card has no annual fees, no late fees, no foreign transaction fees. But unpaid balance will accumulate interest. Rate of Interest on the outstanding bill amount is variable – Variable APRs (Annual Percentage Rate) ranges from 13.24% to 24.24% based on creditworthiness, thereby customers could end up paying a lower amount as interest.

- Most credit card statements emphasize on the minimum amount due, post which interest is charged at about 3% per month (about 36% per annum) on the outstanding amount, which is a lot of money. In case of Apple Card, customer can estimate (in real time) the interest he will end up paying, based on the amount he chooses to pay then. This is linked to the customer’s creditworthiness. Variable APRs (Annual Percentage Rate) is applied to calculate this interest which is expected to range from 13.24% to 24.24% based on his creditworthiness. Thereby customers could end up paying a lower amount as interest using Apple Card.

- Goldman Sachs is an investment bank which recently announced its foray in retail banking which is the issuing bank for Apple Card. MasterCard is their global payment network, so Apple Card can be used all over the world.

- There are no fees of any kind charged on Apple Card. No annual fee, late fee, over-limit fee.

-

-

-

- The rewards program of Apple is called Daily Cash. Customers will receive 2 percent cash back on general purchases or 3 percent on purchases from Apple. With physical Apple credit card, you will then get back 1 percent cash back.

-